LONDON — European stocks nudged just above the flatline in late trade Thursday, helped along by a revival in confidence around the U.S. economy.

The pan-European Stoxx 600 index closed 0.02% higher after spending most of the session in the red, with sectors remaining in mixed territory. Media and chemicals stocks both slipped 0.6%, while travel stocks gained 1.28%.

Global markets have been choppy after a rout at the start of the week. On Wall Street, stocks gained after U.S. weekly initial jobless claims figures came in lower than expected, alleviating some concerns about the state of the labor market.

Last Friday's U.S. jobs report had shown slowing employment growth, sparking recession fears and subsequent market volatility.

The Hurricane season is on. Our meteorologists are ready. Sign up for the NBC 6 Weather newsletter to get the latest forecast in your inbox.

Read more

Weekly jobless claims fall to 233,000, less than expected, in a positive sign for labor market

Sahm Rule creator doesn’t think that the Fed needs an emergency rate cut

There was an element of market overreaction to that initial jobs report, Janet Mui, head of market analysis at RBC Brewin Dolphin, told CNBC's "Squawk Box Europe" on Thursday morning.

"The jobs data is actually not that bad, employment is still growing and particularly importantly, real wage growth is still positive. That's a good back drop for consumer generally," Mui said.

Money Report

"There is clearly a slowdown there which has been brewing for a while and I think that adds to market concern, and of course a lot is positioning of speculative investors and traders," she said, adding that her base case for the U.S. economy remained a soft landing rather than a recession.

European earnings came from firms including German industrial technology giant Siemens, which reported a better-than-expected quarterly operating profit and a confirmation of its full-year outlook.

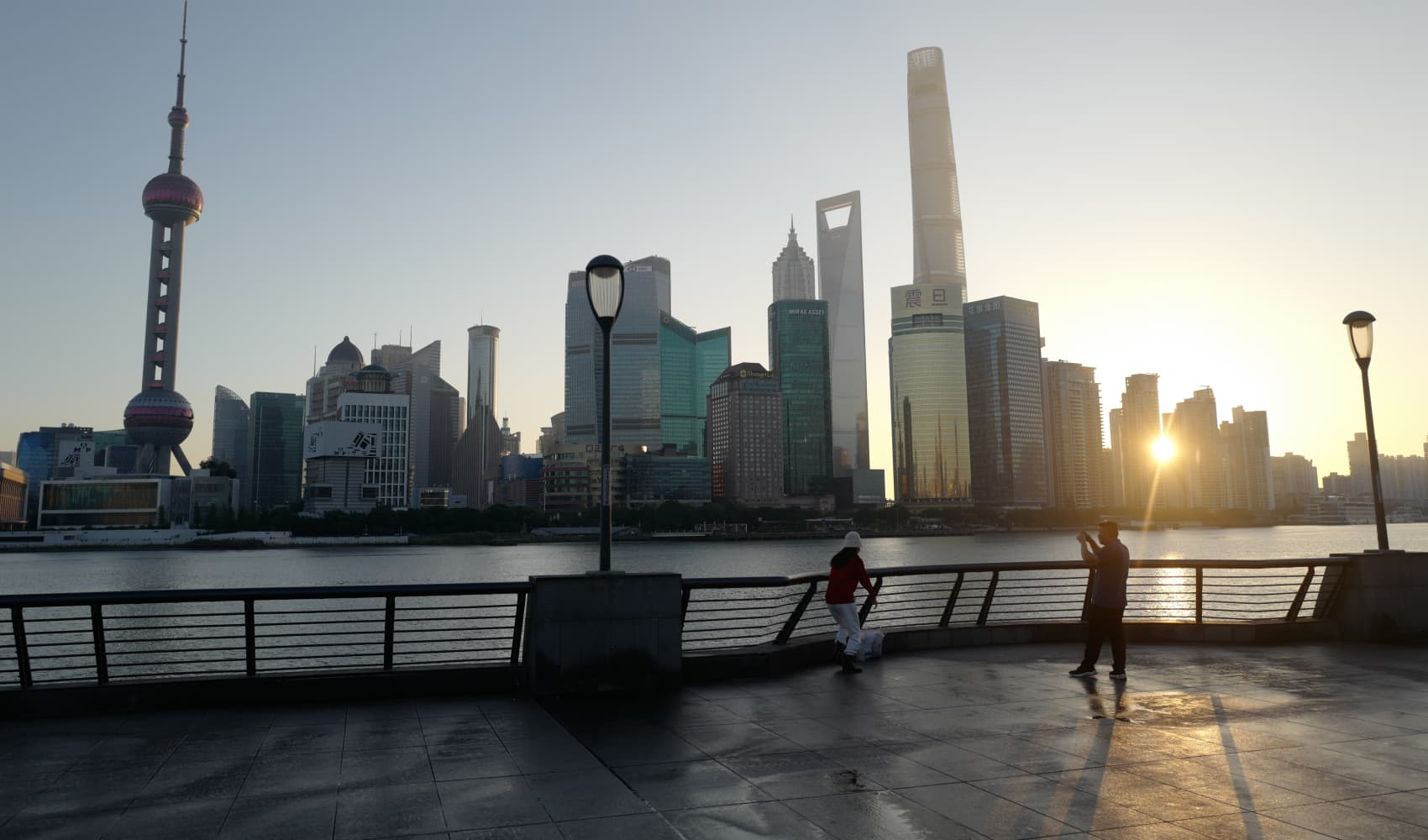

Asia-Pacific stocks were mixed in choppy trading Thursday, as investors assessed trade data from Japan and a rate hold from the Reserve Bank of India.