TALLAHASSEE --- Retailers hope Floridians will heed multiple forecasts that the upcoming hurricane season will be more active than normal.

With the start of a 14-day sales tax “holiday” on storm-related items a little more than a week away, Florida Retail Federation President Scott Shalley said May 22 it is important that residents are ready as “we’ve already seen some pretty severe weather in the state.”

“It’s an opportunity to save some money, yes, and it’s an opportunity to generate activity for our retailers,” Shalley said of the tax holiday. “But most importantly, it’s an opportunity for Floridians to be reminded about hurricane season, to prepare for hurricane season and to get essential supplies.”

The Hurricane season is on. Our meteorologists are ready. Sign up for the NBC 6 Weather newsletter to get the latest forecast in your inbox.

The tax holiday will run from June 1 to June 14 and is timed with the start of the six-month hurricane season. It is part of a wide-ranging tax package (HB 7073) that lawmakers passed in March and Gov. Ron DeSantis signed May 7.

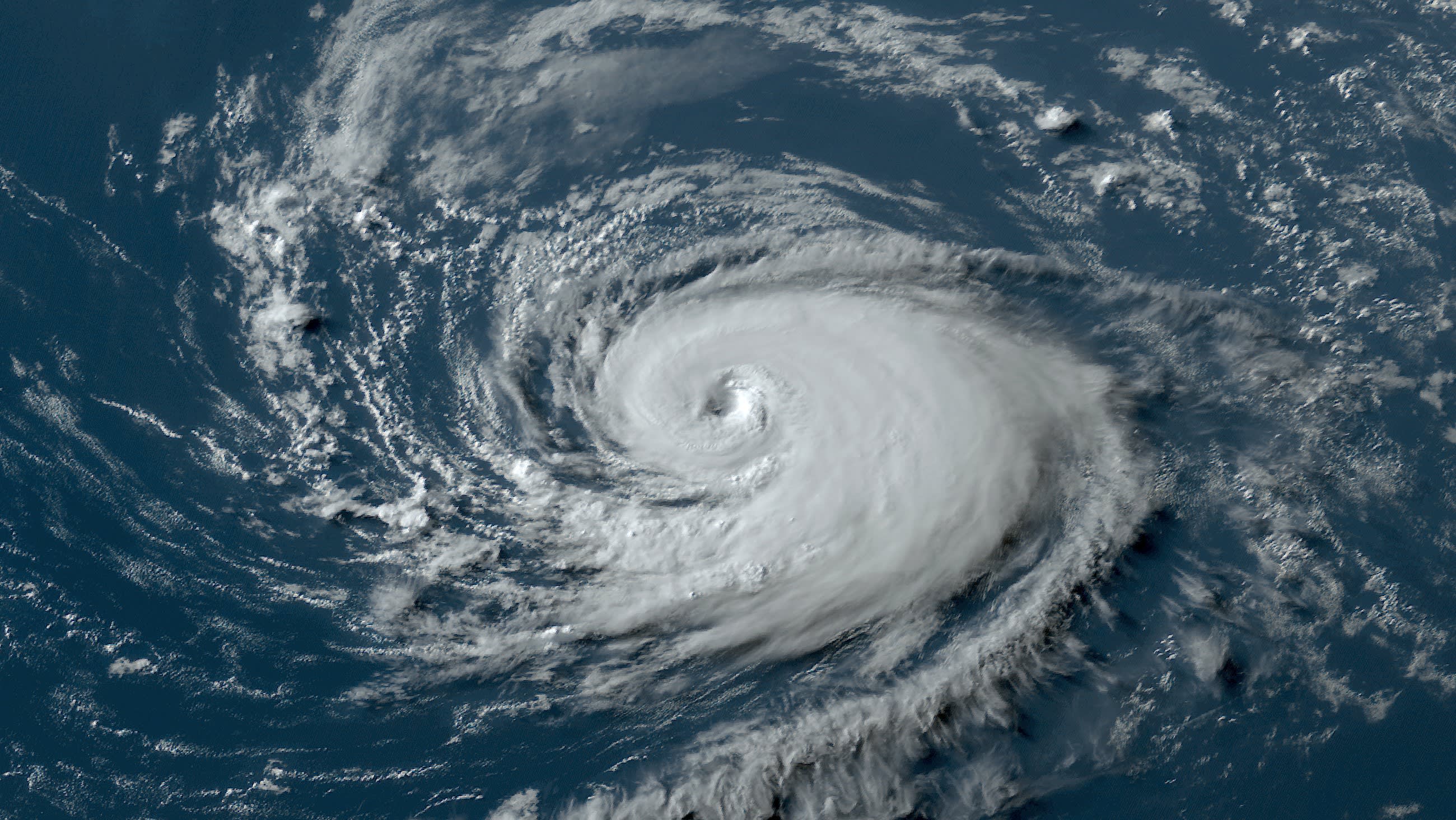

The private meteorology company AccuWeather has projected a “turbulent” hurricane season, with the number of storms potentially exceeding the 21 names the World Meteorological Organization assigns annually for Atlantic hurricanes. Colorado State University researchers also have forecast a “very, very busy hurricane season” based on expected La Niña conditions that would result in hurricane-favorable wind shear conditions and warm water.

During the tax holiday, consumers will not have to pay sales taxes on items ranging from packages of batteries to portable generators.

A second “holiday” for the same items will be held for 14 days starting Aug. 24, ahead of the mid-September peak of the season.

State economists have projected the savings to shoppers during the two periods at $80.2 million, cutting state revenue by $63.3 million and local government revenue by $16.9 million.

Shalley said he expects retailers to offer complementary sales as hurricane season starts.

“I think anybody in the hardware industry, obviously, is super important in this regard. You're gonna see those sorts of sales,” Shalley said. “The tax holiday also covers a wide range of pet supplies, pet medicines, pet food and those sorts of things. So, those are the types of retailers that are going to really be able to offer the sales and focus on disaster preparedness.”

The preparedness tax holiday was first offered in 2006, following the damaging 2004 and 2005 storm seasons. The Legislature has approved it each year since 2017. Pets supplies and medicines have been added to the mix since 2022.

Among other things, shoppers will be able to avoid taxes on reusable ice packs costing $20 or less; portable radios, fuel tanks and packages of batteries costing $50 or less; food-storage coolers costing $60 or less; tarps costing $100 or less; and portable generators costing $3,000 or less.

Also, the tax exemptions apply to such things as wet dog or cat food costing $10 or less; pet leashes costing $20 or less; cat litter costing $25 or less; pet beds costing $40 or less; and over-the-counter pet medications, pet carriers and bags of dry dog or cat food costing $100 or less.