Hurricane Idalia's impact on the insurance industry remains to be seen, but Citizens policyholders may have dodged a surcharge — for now.

"We have to check and see because where Idalia has hit, thankfully, is not as populated, so we need to see how many Citizens policies were actually written in that area," said insurance expert Dulce Suarez-Resnick. "As you know, the main territory for Citizens and policies written is in southeast Florida."

Suarez-Resnick has nearly 40 years of experience in the industry. She believes Idalia will have an effect on insurance rates in the short term.

"We won't see rates stabilize or go down until 2026. And the reason is because every time there is a storm, it takes three years for the reinsurance cost, and that is the cost of the reinsuring windstorm for the insurance companies for them to level off," Suarez-Resnick said. "So we have had storms year after year. So with Ian and Nicole, we were hoping for 2025, now that we've added Idalia, that puts us at another three years."

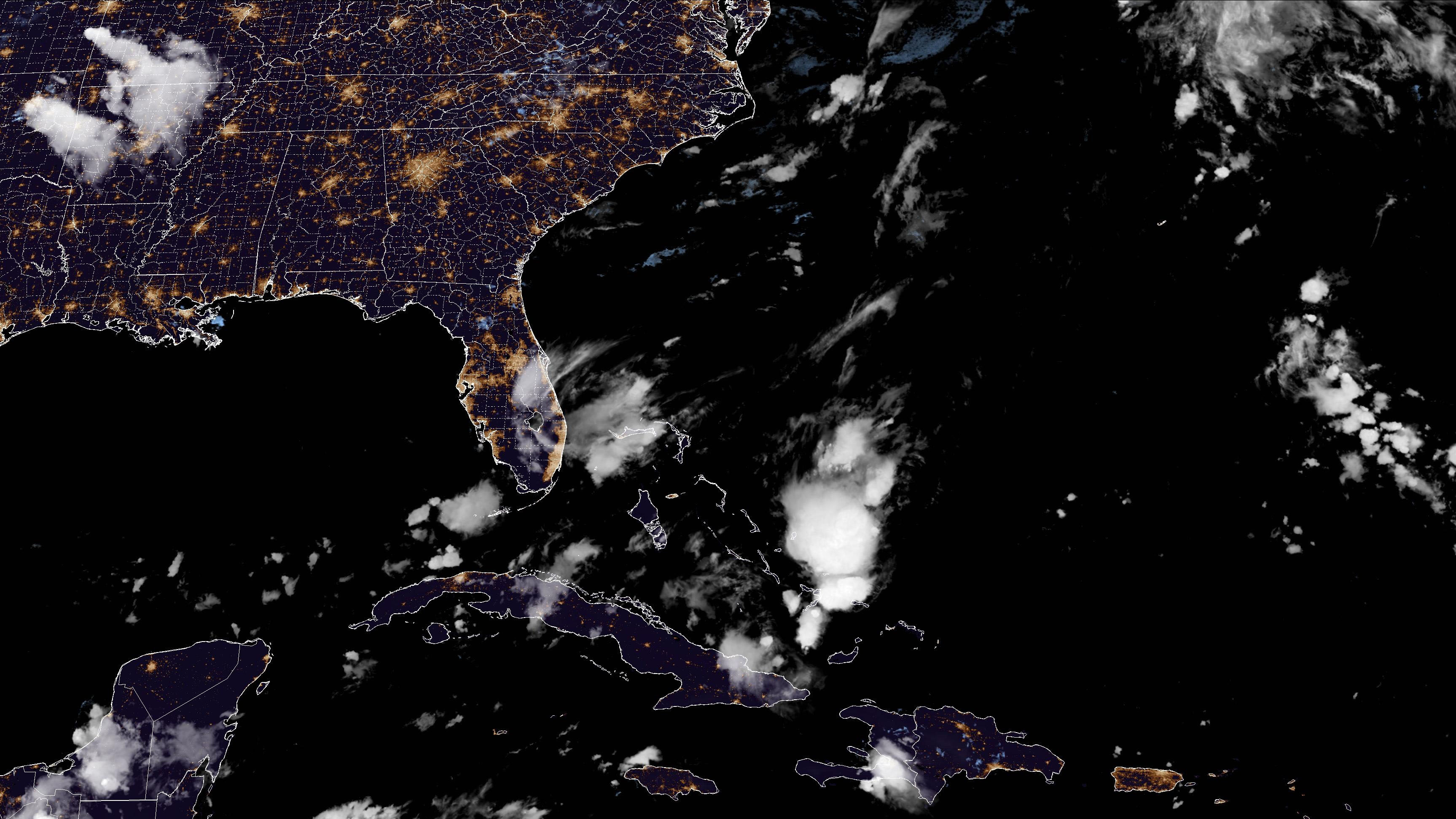

The Hurricane season is on. Our meteorologists are ready. Sign up for the NBC 6 Weather newsletter to get the latest forecast in your inbox.

In December, state lawmakers passed sweeping changes to property insurance laws, but Sen. Ana Maria Rodriguez and Congressman Daniel Perez both agree more needs to be done.

"The goal is for people not to leave the state and for people to be able to afford their homeowner's insurance and especially for those who are on fixed incomes," Rodriguez said.

"We also have to hold the insurance carriers accountable," Perez said. "And I think we are going to see that in the upcoming months. Unfortunately, we are in the middle of a hurricane right now. We want to make sure that the insurance carriers are going to be held just as accountable as the clients."

Local

As the threat of other hurricanes continues this season, insurance experts recommend Floridians take a close look at their policies and understand what's covered. Assessing the need for flood insurance is also key.

"If the flood happens because of a hurricane, it's still a flood. It's not going to be hurricane coverage," Suarez-Resnick said. "So you have to have a flood policy. Now there's a big misconception, 'Oh I'm not in a flood zone.' I hate to break it to you, but the entire state of Florida is a flood zone."