This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

Living in a house near the beach with your dog and space to play your ukulele may sound like the makings of a dreamy retirement.

Watch NBC6 free wherever you are

But for Ethan Nguonly, it's only the beginning.

The 22-year-old is a proud member of the FIRE movement, meaning he's focused on financial independence and retiring early. You could say he's been on this journey since before he was a teenager.

Get local news you need to know to start your day with NBC 6's News Headlines newsletter.

Nguonly may not have known he wanted to retire early when he was only 11, but it was then he began to understand and appreciate the value of investing. He credits his parents with teaching him what it means to invest in stocks and how it can help your money grow.

"[My parents] really explained it to me well," Nguonly tells CNBC Make It. "They said, 'If you leave your money here [in a savings account], over time, it's going to become worthless,' and they said that you should really learn to invest it into something."

Investing early and often, along with hustling through college to avoid debt and saving money by living with family, have helped him make noticeable progress toward his goal of amassing $5 million and retiring by the time he's 35.

Money Report

He currently has close to $135,000 invested across his retirement and other investment accounts, as well as homes in Florida and California. He plans to expand his real estate portfolio in the near future.

Living in Orange County, California, Nguonly aims to spend intentionally in order to put as much money as he can toward his investments. He earns around $194,000 a year working for Google, which includes a base salary of $134,000, 15% annual bonus, on-call compensation of around $10,000 a year and $30,000 in restricted stock units.

His income has allowed him to live comfortably, but he tries not to spend excessively. "I try to live as frugally as possible without compromising the quality of my life," he says.

Investing from a young age

When he first started investing, Nguonly's mother gave him a few companies to choose from, and she would purchase stocks on his behalf. As he grew older, he continued to put money he earned from tutoring younger students into his brokerage account.

"When I was younger, the main thing I was thinking about was, 'All this money keeps getting bigger, keeps growing, and I'm not doing any work for this,'" Nguonly says. "This really exposed me to the idea that my investments could make me money instead of me actually having to actively work for it."

Nguonly's early financial lessons didn't stop there. As he prepared to go to college, his parents said they would pay for two years of school, but the rest would be up to him. In an effort to avoid taking on student debt, Nguonly decided he would graduate with his bachelor's degree in just two years.

In May 2021, he successfully completed his computer science degree at the University of California, Berkeley in half the typical time and without taking out loans by stacking his course load and taking classes over the summer.

The Covid-19 pandemic also disrupted Nguonly's undergraduate experience when lockdowns sent him home from campus during his first year. While he couldn't have avoided that situation, "I wish I was able to experience this period of my life a little bit more," he says.

Still, he doesn't regret cramming college into two years. "It was definitely worth it as I was able to put my financial goals [first] and really get started on a journey towards financial independence," he says. "I would make that sacrifice again."

'If I could get into Google, my life would be complete'

Nguonly's passion for computer science began well before he went to college. In middle school, working on a robotics project for a science fair sparked his interest in the field, he says. He was able to grow his skills throughout high school.

"[Computer science] had always been a passion of mine and I was pretty decent at it, too," he says. "I felt like I was able to do something I enjoyed for work while also being able to make a living out of it. And I feel like I got lucky in that."

After finishing his undergraduate degree, Nguonly landed a job at Qualtrics, a software company. On the side, he also started pursuing his master's degree in information and data science at UC Berkeley.

He took the same aggressive approach he did in undergrad: finish quickly, without too much of a financial burden. In just under a year — while working full-time — Nguonly graduated with his master's in August 2022.

In the midst of getting his master's, Nguonly went after another goal: working for Google.

"It's been a lifelong dream for me to work for Google," he says. "I saw that Google has such a massive impact and the company is always doing the frontline innovation ... If I could get into Google, my life would be complete."

Nguonly was successful: He landed a job there in December 2021 as a software engineer. And with money he saved from working and a tuition reimbursement from Google, he was able to pay for his master's without taking on student loans.

From his family's homes to a house of his own

Though his pay at Qualtrics and salary of $118,000 during his first year at Google were enough for Nguonly to live on his own, he continued living with family members throughout the first two years after finishing his bachelor's degree. This allowed him to save and invest as much of his income as possible.

While he's grateful for his family's support and enjoys spending time with them, it was a little uncomfortable at times trying to live his life as an independent adult.

"There are a lot of restrictions — you can't do whatever you want, you can't have guests over whenever you want," Nguonly says. "It's not necessarily for everyone, but in my case, I was able to make it work and I'm glad that I did ... I don't think I would have been able to buy my two properties if I had not."

He estimates he was able to save about $60,000 over two years between living with his parents in Virginia and his great-grandmother in California.

At the beginning of 2022, Nguonly purchased his first home: an investment property in Riverview, Florida.

Though many homeowners buy the home they plan to live in first, "I knew that once I had a big mortgage to pay each month, it'd be very difficult for me to save at the same rate," he says. "I wanted to be able to build up investments before I [bought] a home to live in."

Plus, Nguonly was able to buy the rental property from his uncle and skip paying realtor fees. It was a mutually beneficial arrangement — his already-retired uncle didn't want to continue maintaining the property and Nguonly was eager to establish a real estate portfolio for himself.

The primary challenge with this property, however, has been Nguonly's distance. While being an out-of-state landlord can be difficult at times, he says, he has a few trusted professionals, including a handyman and a realtor in Riverview, he's able to call to be on-site as needed.

Major repairs like replacing the roof last year, damage to a fence from Hurricane Ian and, most recently, replacing the air conditioning, have cut into his profitability. He currently earns about $200 a month in rental income.

About a year after buying his investment property, Nguonly purchased his primary residence in La Palma, California. The 3-bedroom townhome cost $647,000, and he currently lives there alone with his Samoyed puppy, Sakura.

He enjoys the stability of being a homeowner and avoiding annual rent increases. Plus, he has a little backyard for Sakura to run around, and plenty of room for his own hobbies, which include playing ukulele and piano, singing and skateboarding.

"I love living in Orange County, where the sunshine never ends and the beaches are stunning," he says.

How he spends his money

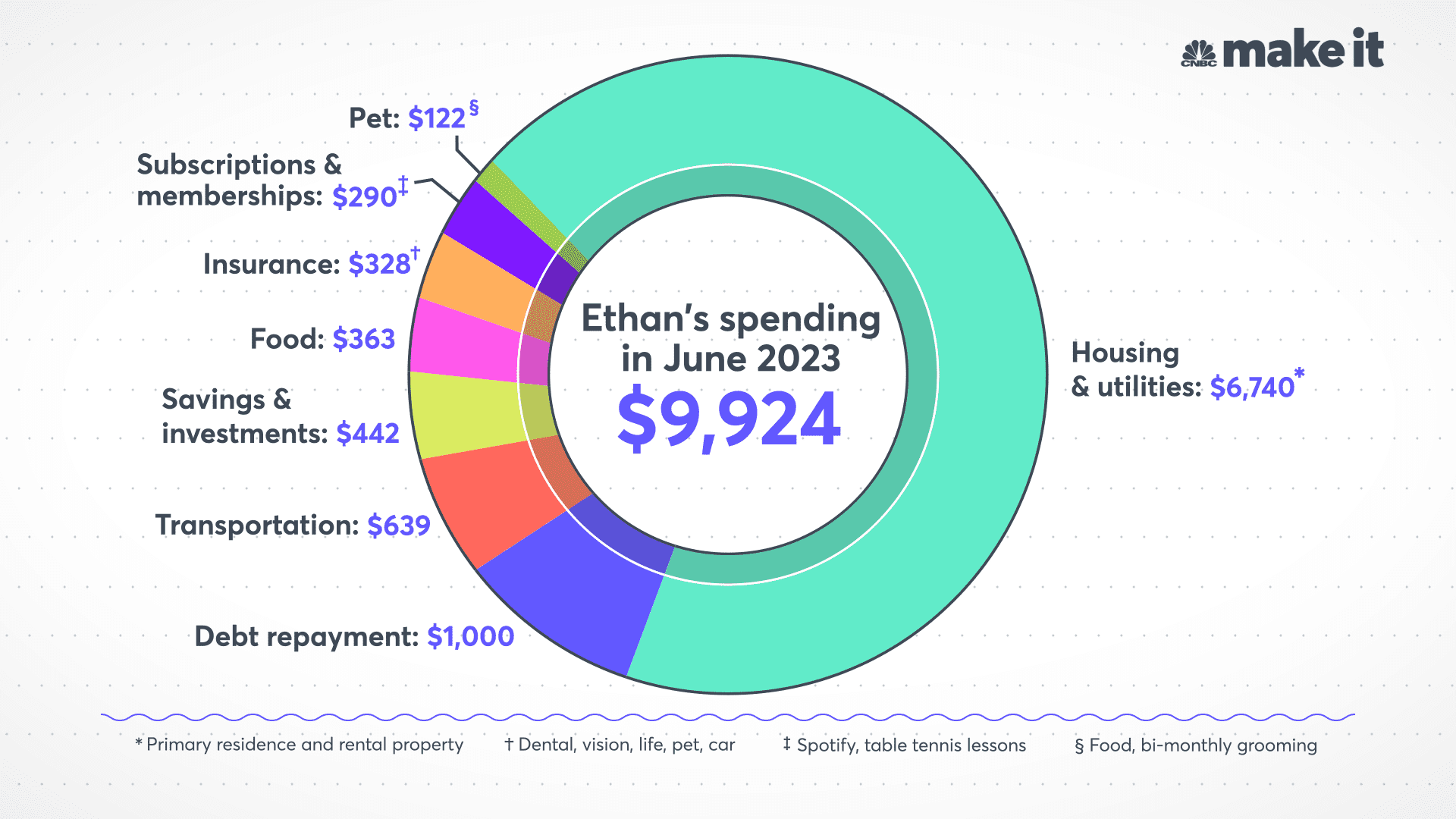

Here's how Nguonly spent his money in June 2023.

- Housing and utilities: $6,740 between his two mortgage payments, homeowners association fees, internet, electric, gas and water bills

- Debt repayment: $1,000 toward his only outstanding credit card balance from repairing the air conditioning at his rental property. He has about $10,600 total left to pay off.

- Transportation: $639 for his Tesla payment

- Savings and investments: $442 toward his brokerage account and health savings account

- Insurance: $328 for dental, vision, life, pet and car insurance

- Food: $363 mostly on takeout, plus some groceries

- Subscriptions: $290 on ping pong lessons and Spotify

- Discretionary: $122 on dog food and grooming every couple of months

Nguonly typically contributes more toward his investments, but has recently been focused on paying off his credit card debt.

And instead of contributing to his 401(k) on a monthly basis, he maxed it out at the beginning of the year using his first few paychecks and a bonus check he received in January. He does this to get his company's 50% contribution match as quickly as possible.

Nguonly drives a Tesla so he doesn't have to worry about paying for gas. His electric bill is pretty high though, around $200 a month, because he usually charges his car at home. He could charge it for free on Google's campus, but "sometimes there's a line so I usually don't bother," he says.

Since moving out on his own, Nguonly has continued to spend intentionally on the things that matter most to him, putting the rest toward his long-term financial goals. His only subscription-like expenses are for Spotify and ping pong lessons.

He doesn't spend too much money on food because Google provides free breakfast and lunch, which he takes advantage of when he's in the office, at least three days a week. At home, he cooks a little, but mostly orders takeout.

"I refuse to spend money on brand-name clothes and streetwear," Nguonly says. "I get the appeal for some people, but it doesn't appeal to me and I prefer to live by more simplistic and affordable clothes that also serve their purpose well."

When he does splurge, Nguonly enjoys traveling, and usually takes three to four trips a year. In the past year, he's visited New York, Singapore and Cambodia. And true to form, he sticks to lower-cost options rather than luxury upgrades, such as sharing an Airbnb with a friend, rather than splurging on a nice hotel.

"I only travel when I feel the enjoyment I will get from the experience significantly outweighs the costs," he says.

Nguonly also puts a lot of his income toward investing for the future, aiming to invest 35% of his take-home pay each year. However, he admits it's become harder to hit that target since buying his homes.

His biggest money mistake

Between well-funded retirement accounts and his budding real estate portfolio, Nguonly is making progress toward his early retirement goal. But he didn't get this far without making mistakes.

Back in 2021, he made what he calls his biggest financial mistake so far by investing in crypto too heavily on margin. It cost him around $80,000 — $30,000 on his initial investment and an estimated $50,000 in unrealized gains over about seven months, he says.

"I was investing with money that I didn't necessarily have," Nguonly says. "Once the crypto market kind of reversed, my losses were amplified."

He learned a big lesson in speculative investments during that period. Now, despite having more money to invest, he aims to play it safer to protect his assets and focus on long-term growth.

"As my net worth and investment portfolio has grown, my risk tolerance has definitely decreased quite a lot," Nguonly says. "It is harder to make [back] money that you've lost than to keep the money that you already have, so I invest fairly cautiously now."

While he's kept a significant amount of money in crypto, Nguonly now mainly focuses on investing in ETFs and real estate.

Looking ahead

To reach his $5 million goal, Nguonly plans to continue investing in his retirement accounts and adding to his real estate portfolio. He hopes to buy a new property every couple of years.

Although he knows firsthand how difficult it can be to manage rental properties, he's up for the challenge. He sees real estate investments as a way to eventually bring in mostly passive income. "Even though I'm successful now, there's always more for me to shoot for," he says.

Nguonly hopes that retiring early will allow him to spend more time with his future children. He was partially inspired by the book "Die With Zero," by Bill Perkins.

"It talks about how you should spend more money on experiences and travel while you're still young and healthy. This is why I really set out this goal," he says.

"I don't want to be 67 years old trying to climb up some mountain, I'd rather do it while I'm still able to fully enjoy these experiences."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

DON'T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Get CNBC's free Warren Buffett Guide to Investing, which distills the billionaire's No. 1 best piece of advice for regular investors, do's and don'ts, and three key investing principles into a clear and simple guidebook.