- Onvo, the lower-priced brand launched by premium electric car company Nio, announced its first car, the L60 SUV, would start as low as 149,900 Chinese yuan ($21,210) when buying battery services.

- A model with the battery and the car starts at 206,900 yuan.

- Deliveries are set to begin Sept. 28.

HEFEI, China — There's yet another Chinese electric car aiming to undercut Tesla, with a steeper discount.

Onvo, the lower-priced brand launched by premium electric car company Nio, announced its first car, the L60 SUV, would start as low as 149,900 Chinese yuan ($21,210) when buying battery services via a monthly subscription, starting at 599 yuan. That's the equivalent to just over $1,000 a year for "renting" the battery.

A model with the battery and the car starts at 206,900 yuan. Deliveries are set to begin Sept. 28.

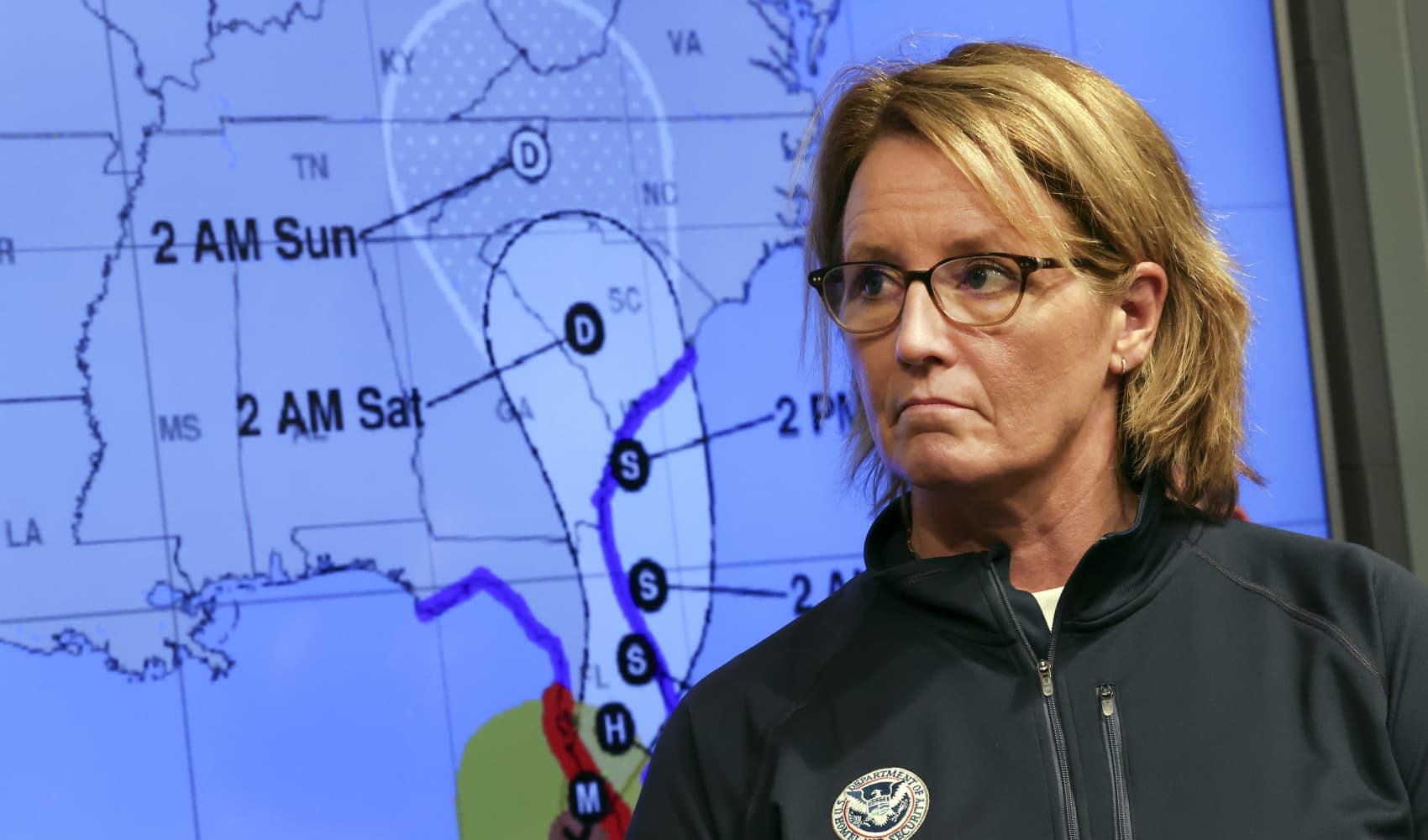

The Hurricane season is on. Our meteorologists are ready. Sign up for the NBC 6 Weather newsletter to get the latest forecast in your inbox.

Nio shares briefly rose by more than 3.5% in U.S. trading Thursday after the Onvo L60 launch.

The L60's new price is even less than what the company announced previously. When Nio launched the Onvo brand in May, the company said the L60 would start selling at 219,900 yuan versus Tesla's Model Y at 249,900 yuan.

Nio CEO William Li told CNBC in an exclusive interview Thursday that he hoped to launch Onvo in Europe as soon as next year, but he did not have a specific timeframe to share.

Money Report

He said the lower-priced brand would help the company better reach a global market, due to growing tariffs and other challenges for the premium Nio brand to reach its target overseas markets of Europe and the U.S.

As for whether Onvo would cannibalize the Nio-branded sales, Li said the two brands are aimed at very different price segments. He noted how Nio's deliveries have improved since the company announced its plans for Onvo.

China's electric car industry has become fiercely competitive over the last few years, with Nio and other companies vying for part of Tesla's market share.

Geely-backed Zeekr is set to launch its first midsize electric SUV, the Zeekr 7X, in China on Sept. 20, starting at 239,900 yuan.

Xpeng in late August announced its mass market brand Mona would begin sales of its M03 electric coupe in China. The basic version starts at 119,800 yuan, with a driving range of 515 kilometers (320 miles) and some parking assist features.

A version of the Mona M03 with the more advanced "Max" driver assist features and a driving range of 580 kilometers will sell for 155,800 yuan.

In comparison, Tesla's cheapest car — the Model 3 — costs 231,900 yuan in China, after a price cut in April.

Chinese electric car companies have gradually expanded overseas, often starting with Europe. However, the European Union is nearing the end of a process that would increase tariffs on imported Chinese-made battery electric cars starting in early November. The bloc began an investigation into the Chinese EV makers' use of subsidies last year.

Nio cooperated with the EU's probe but was not sampled, meaning its cars would be subject to a 20.8% duty, as of a July announcement from the European Commission. That's higher than the 19.9% tariffs slated for Geely cars, and 17.4% for BYD's.

In the fourth quarter, Nio plans to start deliveries in the United Arab Emirates, Li told investors on an earnings call on Sept. 5.

"Because of the tariff in Europe now, selling or exporting cars from China to Europe becomes more expensive," Li said, according to a FactSet transcript.

"So we will focus on the existing five European markets that we have already started. We also know that to establish NIO such a premium brand in the European market will also take a longer time, and we are very patient with that."

"But in the meantime, it doesn't mean that we have stopped our activities there," Li said. "Earlier this year, we have just opened our NIO house in Amsterdam, and we are still installing and deploying our power swap stations in Europe."

He expects the L60 to reach 10,000 monthly deliveries in December, and 20,000 vehicle deliveries a month next year. He anticipates 15% vehicle margin on the new Onvo-branded cars.

The brand aims to have more than 200 stores in China by the end of this year, and already opened more than 100 as of early September.

Li said on the earnings call that Onvo and Firefly, an even lower-priced brand set to begin deliveries next year, would look to release vehicles for the international market.

— CNBC's Sonia Heng contributed to this report.