Nasdaq Surges More Than 1% in Third Straight Positive Session as Tesla Shares Pop

The Nasdaq Composite rose Thursday as Tesla shares surged on the back of better-than-expected earnings results. Tech stocks also got a boost from a softer U.S. dollar.

Watch NBC6 free wherever you are

The tech-heavy Nasdaq gained 1.36% to close at 12,059.61. The S&P 500 added 0.99% to finish at 3,998.95. Meanwhile, the Dow Jones Industrial Average gained 162.06 points, or 0.51%, in a choppy session. The blue-chip index ended at 32,036.90.

The Nasdaq is set for a gain this week, up about 5.3%. Meanwhile, the Dow is nearly 2.4% higher for the week, while the S&P 500 climbed 3.5%.

Get local news you need to know to start your day with NBC 6's News Headlines newsletter.

Investors continued to pivot into tech stocks, which have fueled this week's rally, as some strong corporate results had Wall Street on the hunt for beaten-down assets.

"What you're seeing in the market today is continued potential recovery, some continued potential optimism for numbers not being as bad as feared," said Robert Cantwell, portfolio manager at Upholdings. "But that's been happening in the market now for almost a month."

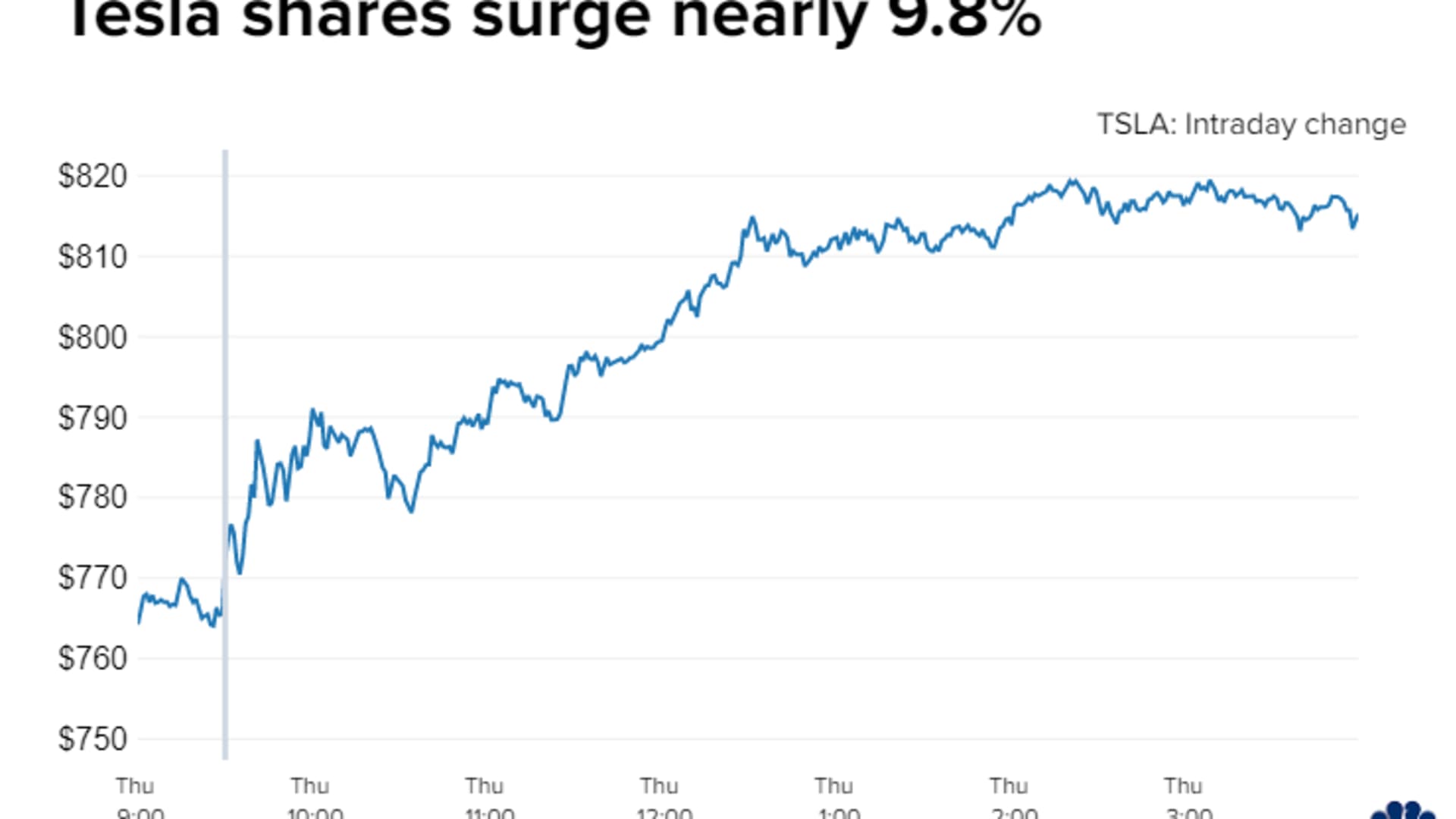

Consumer discretionary stocks led gains in the S&P 500, up more than 2% on the back of Tesla shares. The automaker surged about 9.8% after it reported stronger-than-expected results despite shrinking automotive gross margins. Shares are still down nearly 23% this year.

Meanwhile, the dollar declined following a surprise interest rate hike Thursday from the European Central Bank, which raised rates for the first time in 11 years. The central bank increased benchmark rates by 50 basis points.

Money Report

A weakening dollar could boost shares of tech companies, as several major companies in the space get a chunk of their revenues from outside of the U.S.

Despite those moves, some investors pointed to weak economic reports and greater inflationary pressures as signs that markets have yet to bottom.

"If overall financial conditions keep tightening on the current path, then that means that macro fair value for US equities will continue to trend lower," said Huw Roberts, head of analytics at Quant Insight.

The Philadelphia Fed manufacturing index registered a reading of -12.3, worse than the 1.6 estimate from the Dow Jones.

Meanwhile, initial jobless claims continued their upward trend and touched their highest level since November 2021. Initial claims climbed to 251,000 for the week of July 16, up from an adjusted 244,000 claims from the prior week, in its third straight weekly gain.

AT&T, American Airlines earnings

More than 90 companies in the S&P 500 have reported earnings to date for the second quarter, and 78% reported above analyst expectations, according to Refinitiv.

AT&T dropped 7.6% after lowering its full-year free cash flow guidance. Still, the telecommunications company exceeded expectations in its second quarter.

American Airlines fell 7.4% after cutting back on growth plans despite reporting earnings mostly in line with expectations. Still, the company forecasted a profit in the third quarter.

United Airlines' results came in below expectations, pushing the stock down about 10.2%.

Carnival dropped roughly 11.2% after the cruise company announced that it was selling an additional $1 billion of stock.

Snap is expected to report after the bell.

Lea la cobertura del mercado de hoy en español aquí.