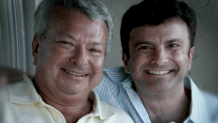

Scott Anderson describes his father Stuart as a great and sophisticated man with a good eye for businesses. But in 2011, he found himself in a tough spot.

“He became distressed in the home and was being foreclosed upon,” Scott said.

Stuart fell behind on the mortgage payments of his Coral Springs home, like so many Americans in the wake of the 2008 housing crisis.

It was then, Scott says, his father was contacted by a company called First Capital Land Trust — marketed in an advertisement as relief for homeowners underwater in their properties.

He says his dad agreed to do a “cash for keys” deal, signing what’s known as a quit claim deed and transferring the ownership of his home to the company in exchange for $2,500.

Scott and his sister Janice Wilson allege in a lawsuit filed against First Capital that the company told their dad they could negotiate with the bank and “promised to pay all debt associated with the Property in exchange for the Deed.”

“He thought getting $2,500 was nice and that this company was going to take care of anything,” Scott said.

Stuart was 74 at the time and the lawsuit claims he was “unduly influenced” when he made the deal.

“My dad was suffering at that point from heart disease and he was getting a little bit old and confused,” Scott said.

After moving out, Scott says his dad started getting letters from the bank — informing him he was now very behind on those mortgage payments.

“That’s when the confusion started because he didn’t understand why he was going to court for a house he didn't own,” Scott said.

'IF SOMETHING SOUNDS TOO GOOD TO BE TRUE, IT USUALLY IS'

Marilyn Uzdavines is a professor at Nova Southeastern University Shepard Broad College of Law who specializes in real estate transactions.

She says the problem was this: while Stuart no longer owned the home, it was still his name on that mortgage.

“This third party wouldn't really have any ability to negotiate down the debt that's owed by the homeowner,” she said.

Uzdavines explains there are legitimate “cash for keys” deals in which lenders can help property owners facing foreclosure but she warns about third-party companies offering this relief.

“If something sounds too good to be true, it usually is,” she said.

In court filings, First Capital Land Trust says there is no evidence of Scott’s claims that his dad was incapacitated when he signed over the home and the statute of limitation is long overdue in these allegations.

HEARTBREAKING LOSS

Scott says his father became increasingly worried.

“It became almost a fixation that they were going to come in…that would take everything he had, all he had left,” he said. “This just devastated him…I remember him saying ‘I don’t want to be a burden on my children’ and I said, 'Why would you say that? We love you, (we) will do anything for you.’”

In October 2016, Scott, who lives in California, was not able to reach his father. He said Stuart was struggling with depression at the time and recovering from a recent heart surgery.

“Saturday, I didn’t hear from him and I called him. Sunday, I called him and texted him. 53 times I tried to reach him,” he said.

Deputies with the Palm Beach County Sheriff’s Office made a devastating discovery inside his apartment.

“He took his own life. He killed himself and I blamed that letter,” Scott said.

On Stuart’s table, investigators found letters from the bank about the foreclosure along with a court ruling detailing hundreds of thousands of dollars owed to the bank for the Coral Springs home.

“Emotionally, I just can’t accept it. Was it worth it everybody?” Scott said.

My dad was worth so much more than a late payment on a mortgage in Coral Springs, Florida.

Scott Anderson

THE COMPANY BEHIND THE DEAL

The NBC6 Investigators found First Capital Land Trust was under investigation the same year Stuart signed over the deed to his Coral Springs home.

The FTC alleged several companies, including First Capital Land Trust and its then owner, Lazaro Dinh, preyed on financially distressed homeowners, charging them up to $750 a month that was supposed to get them legal help to fight foreclosure. It was part of what the FTC described as a crackdown on “phony mortgage relief schemes.”

“He (Dinh) did not do that here. He paid for the house. So it’s a very different transaction,” Scott said, referring to his dad’s case.

Dinh has also gone by the names Mario Lazaro Sopena and Lazaro Sopena, according to the FTC.

As part of a settlement agreement with the agency, Dinh and First Capital were barred from doing mortgage relief work. That settlement didn’t take place until a year after Stuart transferred the ownership of his home to the company.

In Stuart’s case, First Capital became the owner of the home, but not the mortgage payments — which records show went unpaid.

Fast forward 11 years, the bank has been fighting all this time to foreclose and First Capital is still fighting to keep the house.

It’s no surprise.

It cost them just $2,500, but the NBC6 Investigators found it’s been a money maker, bringing in rental income for years.

“Their end game is not the foreclosure; their end game is the process. The longer the process undergoes, the more revenue they collect by renting the house,” Scott said.

Through court records, NBC6 Investigators located Michelle Grote, who was listed as a tenant for the property.

She told us her family rented the home from 2015 to early 2017.

“We kept getting letters in the mail. A lot of letters,” she recalled. “I told my husband this house has been in foreclosure since 2011.”

If it’s in foreclosure status, where is my money going?

Michelle Grote, former tenant

Grote says she fell behind on her rent due to serious health issues and was eventually evicted.

But before that, Grote said she made payments to a company called Premier Rental Management during her time as a tenant.

NBC6 Investigators looked into Florida business records and found that the company is listed as the registered agent for First Capital Land Trust.

We couldn’t find a working website for either, but both companies list their principal address as a mailbox located inside a packaging shop on Las Olas Boulevard in Fort Lauderdale.

“Is Premier Rental Management even a company that’s real?” Grote said.

We found that the same mailbox is associated with several other companies, including a real estate investment business managed by Lazaro Dinh, the same person who owned First Capital when Stuart signed over his home and was fined by the FTC in that unrelated scheme.

The most recent annual report for First Capital is signed by his wife, Hanh Dinh.

We spoke with the couple over the phone, and they say they are no longer involved with First Capital Land Trust and records showing Hanh’s affiliation with the company are a mistake.

Both ended the calls before answering any more questions.

Bruce Botsford, the attorney representing the company in the foreclosure case, didn’t want to talk to us either, texting in part, “You can leave me out of this one.”

A LONG LEGAL FIGHT

Scott says losing his dad motivated him to enroll in Purdue Global Law School.

It was then that he discovered the fight over the home was not over and the bank had been trying to foreclose for years.

In September 2023, a judge ruled in favor of U.S. Bank, authorizing the foreclosure sale.

When NBC6 Investigators visited the house that day, it appeared empty — a bittersweet relief for Scott.

“As long as First Capital Land Trust isn’t making any more money off it. I'm good with that,” he told NBC6.

But the sale was postponed after First Capital filed a motion in court. When NBC6 visited the house again in November, we discovered a new family was renting the home. They didn’t want to go on camera but told us, just like the Grote family, they had no idea about the pending foreclosure.

“How are they still operating? That is what I don’t understand," Grote said.

In late December, a judge ruled the sale of the property could move forward. Court records show the final bid was made by a real estate company for $458,000.

“I am glad it won’t belong to them anymore and they won't be able to make one more cent on that house,” Scott said, reacting to the news.

His civil case against the company is still pending.