The 2016 Democratic National Convention is underway, and the factual inaccuracies on the first night focused on income, college tuition and something the Republican ticket had said or done.

- Pennsylvania Sen. Bob Casey said Republican presidential nominee Donald Trump “would cut taxes for the richest Americans at the expense of the middle class.” But all income levels would get some tax relief under Trump’s plan.

- Connecticut Gov. Dannel Malloy wrongly claimed that Mike Pence, the GOP vice presidential nominee, “signed a law that would have forced women to hold funerals for fetuses.” The law said aborted or miscarried fetuses “must be cremated or interred” by the hospital or abortion facility.

- Sen. Bernie Sanders said Hillary Clinton “will guarantee” free tuition at public colleges or universities for families with annual incomes of $125,000 or less. But free tuition is not guaranteed. States must put up matching funds for the students to receive free tuition.

- Sens. Casey and Kirsten Gillibrand both claimed that Trump had said that wages are “too high.” Trump was specifically talking about a $15 minimum wage when he made that comment, not wages overall.

- Sanders said the “top one-tenth of 1 percent now owns almost as much wealth as the bottom 90 percent,” a statistic that has been questioned by economists at the Federal Reserve Board.

- Sanders also said the “top 1 percent in recent years has earned 85 percent of all new income,” but economists whose work Sanders has cited put the figure at 52 percent for 1993 to 2015.

- Rep. Joe Kennedy III said Americans’ wages “have not budged in 40 years,” and Sen. Elizabeth Warren said wages were “flat.” Wages plunged in the 1970s and 1980s, and more recently have showed strong growth.

Note to Readers

This story was written with the help of the entire staff, including some of those based in Philadelphia who are at the convention site. As we did for the Republican National Convention, we intend to vet the major speeches at the Democratic National Convention for factual accuracy, applying the same standards to both.

Analysis

Trump’s Tax Plan

Pennsylvania Sen. Bob Casey said Donald Trump “would cut taxes for the richest Americans at the expense of the middle class.” The wealthiest Americans would receive the largest tax cuts under Trump’s tax plan, but everyone would get some tax relief. Middle-income Americans would receive average tax cuts of about $2,700 in 2017 under Trump’s plan, according to an analysis by the Tax Policy Center.

Trump’s plan would, among other things, consolidate the current seven income tax brackets into four, with a top marginal rate of 25 percent (it’s currently 39.6 percent).

U.S. & World

According to an analysis of the plan by the nonpartisan Tax Policy Center, Trump’s proposal would “reduce taxes throughout the income distribution.” Nonetheless, the biggest cuts would come for the wealthiest Americans, in both raw dollars and as a percentage of income, the Tax Policy Center found. The top 1 percent, for example, would get an average tax cut of more than $275,000 (about 17.5 percent of after-tax income) in 2017.

But middle-income people would see a tax cut, too. “Middle-income households would receive an average tax cut of about $2,700,or about 5 percent of after-tax income,” the Tax Policy Center concluded.

An analysis by the Tax Foundation reached a similar conclusion — the biggest gains in after-tax income would accrue to the wealthiest taxpayers under Trump’s proposal. But the plan “would cut taxes and lead to higher after-tax incomes for taxpayers at all levels of income.”

The Tax Foundation analyzed the plan’s impact with (dynamic) and without (static) taking into account the expected effect on the economy. On a static basis, middle-income taxpayers — between the 30th to 80th percentiles — would see an increase in their after-tax adjusted gross income of between 3 percent and 8.3 percent. Taking into account the positive effects on the economy that the tax cuts could be expected to stimulate, the Tax Foundation found middle-income taxpayers — between the 30th to 70th percentiles — would see a nearly 20 percent increase in after-tax adjusted gross income.

The Tax Foundation cautioned that the loss in revenue under Trump’s plan — even with expected benefits to the economy — would “increase the federal government’s deficit by over $10 trillion” over 10 years. One could argue that such large tax cuts might lead to spending cuts that disproportionately affect middle-income taxpayers. But Trump has not been specific about where he would begin making spending cuts.

Funerals for Miscarriages?

Connecticut Gov. Dannel Malloy claimed that GOP vice presidential nominee Mike Pence “signed a law that would have forced women to hold funerals for fetuses, even in some cases, for a miscarriage.” That’s not so.

The controversial anti-abortion bill Malloy referred to, which Indiana Gov. Pence signed into law March 24, contained a provision stating that an aborted or miscarried fetus “must be cremated or interred,” and that the hospital or abortion facility (not the mother, as Malloy suggested) is responsible for the disposition.

Some have characterized this as fetuses receiving “what amounts to a funeral.” But that’s incorrect.

The word “funeral” refers to a ceremony, not to the burial or cremation that follows. For example, Dictionary.com defines “funeral” as “the ceremonies for a dead person prior to burial or cremation.” (Emphasis added is ours.)

And in fact, the Indiana law required no funeral ceremony. It even specified that the parents would not be required to provide a name for the fetus. A federal judge blocked the law from going into effect late last month.

Clinton’s Tuition Plan

Sen. Bernie Sanders said Democratic presidential candidate Hillary Clinton “will guarantee” free tuition at in-state public colleges or universities for families with incomes of $125,000 a year or less. But free tuition would not be guaranteed. States must put up matching funds for free tuition.

Also, the free-tuition plan would be phased in and not available to families earning as much as $125,000 until 2021.

Sanders mentioned the free-tuition plan in his speech as an example of how Clinton has adopted some of his ideas for the general election in a show of unity after the contentious primary.

Sanders: During the primary campaign, Secretary Clinton and I both focused on [college debt] but with different approaches. Recently, however, we have come together on a proposal that will revolutionize higher education in America. It will guarantee that the children of any family in this country with an annual income of $125,000 a year or less – 83 percent of our population – will be able to go to a public college or university tuition free.

Clinton announced her plan on July 6, but her plan calls for states to “step up and invest in higher education.” The New York Times wrote that “the federal government would provide tuition grants to states that agree to put up some matching money.”

The paper noted that “some experts said details of the initiative — including exactly how it would work and be paid for — were sketchy, and raised concerns that some states would decline to contribute money.”

More recently, Times columnist Kevin Carey wrote, “States will be able to opt out of the Clinton plan, just as a significant number have chosen not to accept large federal subsidies to expand Medicaid under the Affordable Care Act.”

Also, free tuition would be gradually phased in, beginning with families earning $85,000 or less. “By 2021, families with income up to $125,000 will pay no tuition at in-state four-year public colleges and universities,” Clinton’s plan says.

So Sanders overstates the impact of Clinton’s plan when he says it “will guarantee” free tuition for families with incomes of $125,000 a year or less. Actually, the plan “could eventually provide free in-state tuition to eligible students,” as the Times writes.

Trump on Wages

Two speakers claimed that Trump had said that wages are “too high” in the United States. Not exactly. Trump said that in response to a question about raising the minimum wage to $15 an hour.

Sen. Casey said that Trump said, “Wages in America, quote, are too high,” and Sen. Kirsten Gillibrand of New York repeated the talking point, saying, “Donald Trump actually stood on a debate stage and said that wages are ‘too high.’”

At a Nov. 10, 2015, debate hosted by Fox Business Network, Trump was asked if he was “sympathetic” to those who were calling for a $15 minimum wage. He responded that he “can’t be” because the country “is being beaten on every front economically.” He went on to say, “taxes too high, wages too high, we’re not going to be able to compete against the world. I hate to say it, but we have to leave it the way it is.” The “it” was the federal minimum wage.

Here’s the question and Trump’s full answer:

Fox News’ Neil Cavuto, Nov. 10, 2015: Mr. Trump, as the leading presidential candidate on this stage and one whose tax plan exempts couples making up to $50,000 a year from paying any federal income taxes at all, are you sympathetic to the protesters cause since a $15 wage works out to about $31,000 a year?

Trump: I can’t be Neil. And the and the reason I can’t be is that we are a country that is being beaten on every front economically, militarily. There is nothing that we do now to win. We don’t win anymore. Our taxes are too high. I’ve come up with a tax plan that many, many people like very much. It’s going to be a tremendous plan. I think it’ll make our country and our economy very dynamic.

But, taxes too high, wages too high, we’re not going to be able to compete against the world. I hate to say it, but we have to leave it the way it is. People have to go out, they have to work really hard and have to get into that upper stratum. But we can not do this if we are going to compete with the rest of the world. We just can’t do it.

Cavuto: So do not raise the minimum wage?

Trump: I would not do it.

Trump was criticized for the comment and was asked about it two days later on Fox News. Trump said, “And they said should we increase the minimum wage? And I’m saying that if we’re going to compete with other countries, we can’t do that because the wages would be too high. … The question was about the minimum wage. I’m not talking about wages being too high, I’m talking about minimum wage.”

Trump’s original statement may not have been clearly worded, but the context, and his explanation two days later, show he was talking about a $15 minimum wage being too high, not all wages in the U.S. in general.

Sanders’ Wealth and Income Talking Point

Sanders continued to strain the facts about inequality of income and wealth, as he had done throughout his campaign.

Wealth: Sanders said the “top one-tenth of 1 percent now owns almost as much wealth as the bottom 90 percent.”

That’s a hotly debated claim. Sanders referred to a study by economists Emmanuel Saez of the University of California, Berkeley, and Gabriel Zucman of the London School of Economics and Political Science, first published in October 2014. Their study indeed concluded that as of 2012, the top 0.1 percent of American households held 22 percent of the nation’s personal wealth, while the bottom 90 percent held 23 percent.

However, as we reported last year, Saez and Zucman’s work has been criticized by economists at the Federal Reserve Board, which has conducted its own studies of the wealth held by U.S. households since the 1960s.

The Fed’s survey data put the share of wealth held by the top 0.1 percent at 14 percent, not 22 percent, and the Fed said that group’s share had grown at only half the rate that the Saez-Zucman study stated.

Furthermore, in a paper published in 2015, four Fed economists argue that the Saez-Zucman methodology has an “upward bias.” It is based on inferring wealth from the income reported on federal tax returns, but the Fed economists argue that this fails to capture untaxed cash benefits to middle-income families, such as employer-paid health insurance and employer contributions to Social Security and Medicare.

Income: Sanders also said the “top 1 percent in recent years has earned 85 percent of all new income.” But that’s no longer so, even according to Saez and Zucman.

A June 2016 update by Saez now puts the percentage of income growth captured by the top 1 percent from 1993 to 2015 at 52 percent. That’s barely half — far below the 85 percent figure Sanders gave.

That same study also found “robust income growth for all groups” between 2013 and 2015, and said that for the bottom 99 percent, “incomes grew by 3.9% from 2014 to 2015, the best annual growth rate since 1999.”

So there is indeed evidence of large inequalities in the distribution of wealth and the growth of incomes. But Sanders exaggerates by using outdated or questionable data.

Roller-Coaster Wages

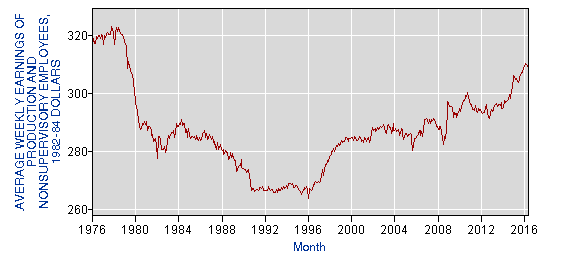

Rep. Joe Kennedy III said Americans’ wages “have not budged in 40 years,” and Sen. Elizabeth Warren, his former law professor, said wages were “flat.” In fact, wages have had a roller-coaster ride during that time, and have been rising for years.

Kennedy: [Elizabeth Warren] taught us that [the law’s] impact lay not in classrooms or textbooks, but in a society where wages have not budged in 40 years.

Wages have more than “budged,” plunging in the 1970s and 1980s, and more recently showing strong growth.

It’s true that real (inflation-adjusted) average weekly wages for rank-and-file, nonsupervisory workers were still 3.2 percent lower in June 2016 than they were 40 years earlier, in June 1976, according to the most recent data from the Bureau of Labor Statistics.

But they were anything but stagnant in the interim, dropping 16.6 percent between January 1976 to the low point in January 1996.

Since then, weekly paychecks for nonsupervisory workers have regained nearly all that loss, and the upward trend continues.

Warren repeated Kennedy’s claim during her own speech, saying that “wages stay flat” in America.

Warren: I mean look around — Americans bust their tails, some working two or three jobs, but wages stay flat.

Actually, real average weekly earnings climbed 8.6 percent in the past eight years, and 4.5 percent in the past four years.

Kennedy and Warren are not the only politicians to have made this incorrect claim recently. “Flat wages” is also a Clinton claim, as we wrote previously here and here, and we flagged Trump on his statement that “wages have not been raised” here.

— Robert Farley, with Eugene Kiely, Brooks Jackson, Lori Robertson and Jenna Wang

Sources

“Making college debt-free and taking on student debt.” Press release. Hillary for America. Undated, accessed 26 Jul 2016.

Saul, Stephanie and Matt Flegenheimer. “Hillary Clinton Embraces Ideas From Bernie Sanders’s College Tuition Plan.” New York Times. 6 Jul 2016.

Carey, Kevin. “The Trouble With Hillary Clinton’s Free Tuition Plan.” New York Times. 19 Jul 2016.

Hulse, Carl. “Candidates Join Clinton in Push for Tuition Plan Inspired by Sanders.” New York Times. 13 Jul 2016.

Donald J. Trump for President. “The Goals Of Donald J. Trump’s Tax Plan.” Accessed 25 Jul 2016.

Nunns, Jim, et al. “Analysis of Donald Trump’s Tax Plan.” Tax Policy Center. 22 Dec 2015.

Cole, Alan. “Details and Analysis of Donald Trump’s Tax Plan.” Tax Foundation. 29 Sep 2015.

Farley, Robert. “Trump on Clinton’s Tax Plans.” FactCheck.org. 28 Jun 2016.

FoxNews.com. “Special Report with Bret Baier” transcript. 12 Nov 2015.

WashingtonPost.com. “Who said what and what it meant: The 4th GOP debate, annotated.” 10 Nov 2015.

Saez, Emmanuel and Gabriel Zucman “Wealth Inequality in the United States Since 1913; Evidence From Capitalized Income Tax Data” National Bureau of Economic Research. Oct 2014.

Bricker, Jesse and Alice Henriques, Jacob Krimmel, and John Sabelhaus. “The Increase in Wealth Concentration, 1989-2013.” Board of Governors of the Federal Reserve System. Jun 2015.

Bricker, Jesse and Alice Henriques, Jacob Krimmel, and John Sabelhaus. “Measuring Income and Wealth at the Top Using Administrative and Survey Data.” Finance and Economics Discussion Series 2015-030. Board of Governors of the Federal Reserve System. April 2015.

Saez, Emmanuel. “Striking it Richer: The Evolution of Top Incomes in the United States (Updated with 2015 preliminary estimates.” 25 Jun 2016.

“House Enrolled Act No. 1337.” Indiana General Assembly.